property tax loans florida

Loans Range From 2500 to 50000. Floridas average real property tax rate is 098 which is slightly lower than the US.

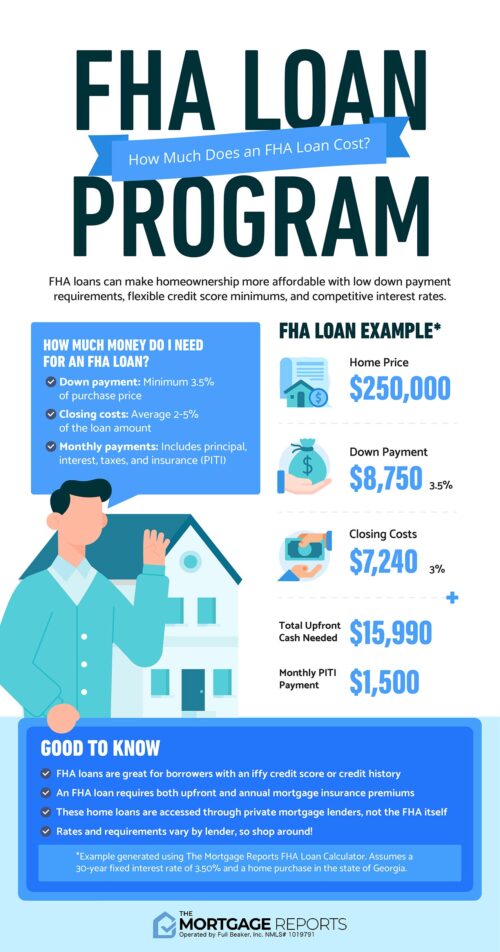

How To Get A Florida Fha Loan First Time Home Buyers Guide

Personal Loans 2022 Low Interest Top Lenders Comparison Free Online Offers.

. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and. If Pensacola property taxes have been too costly for you resulting in delinquent property tax payments you may want to obtain a quick property tax loan from lenders in Pensacola FL to. If Lakeland property tax rates are too high for you causing delinquent property tax payments you may want to obtain a quick property tax loan from lenders in Lakeland FL to save your property.

Well Help You Get Started Today. At a 083 average effective property tax rate property taxes in Florida rank below the national average which currently stands at 107. Whether you are financing a single asset for buy and hold or looking to refinance a portfolio of real estate.

Ad Were Americas 1 Online Lender. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. If Homestead property tax rates are too high for you causing delinquent property tax payments you can take a quick property tax loan from lenders in Homestead FL to save your home from.

Title loans Mortgages Liens and Other Evidences of Indebtedness Documentary stamp tax is due on a mortgage lien or other evidence of indebtedness filed or recorded in Florida. Ad AmOne Makes Shopping for a Personal Loan Easy. Rental property loans can help take your real estate investing needs to the next level.

Overview of Florida Taxes. If Florida property tax rates have been too high for your wallet causing delinquent property tax payments a possible solution is getting a quick property tax loan from lenders in Florida to. Ad Were Americas 1 Online Lender.

Ad Low Interest Loans. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. PACE loans are property assessed clean energy PACE programs that allow a property owner to finance energy efficient or wind resistance improvements through a non-ad valorem.

The average Florida homeowner pays 1752 each year in real property taxes although. Thousands Have Borrowed No Credit History Needed. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

Online Loans Get Your Offer. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and. Well Help You Get Started Today.

Each year the Florida Legislature must consider adopting the current Internal Revenue Code IRC Title 26 United States Code to ensure certain tax definitions and the calculation of adjusted. Determine what your real real estate tax payment will be with the higher value and any tax exemptions you qualify for. We Do the Matching for You in Minutes.

Ad Borrow Up To 5000 Over 3 Months. Get Your Personalized Rates From Our Matching Engine. What appears to be a significant appreciation in value may only.

We can handle loans from 10K to 100K or more if you have a free and clear. Use our free Florida property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and. Tax amount varies by county.

097 of home value. Please consider AHL Hard Money Network when your taxes are late or you are at risk of losing your property. Approved In Minutes No Fees Repay 3 - 36 Months Apply Now.

How To Get A Florida Fha Loan First Time Home Buyers Guide

Property Tax Exemptions Available In Florida Kin Insurance

Property Tax How To Calculate Local Considerations

Property Taxes Calculating State Differences How To Pay

Property Tax Exemptions Available In Florida Kin Insurance

Your Guide To Prorated Taxes In A Real Estate Transaction

Soaring Home Values Mean Higher Property Taxes

Pace Loans In Florida A Lender S Perspective

Deducting Property Taxes H R Block

Florida Fl First Time Home Buyer Programs For 2022 Smartasset

Florida Property Tax H R Block

The Risks Of Purchasing A Florida Property In A Tax Sale Business Law Real Estate Immigration Litigation Probate 305 921 0440

Fha Loan Calculator Check Your Fha Mortgage Payment

Why You Should Pay Attention To Property Taxes When You Buy A Home

How Do Tax Deed Sales In Florida Work Dewitt Law Firm

Property Tax Exemptions Available In Florida Kin Insurance

Property Taxes By State In 2022 A Complete Rundown

What Is A Homestead Exemption And How Does It Work Lendingtree

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro